Wealthy Americans Are Rushing To Set Up Secure Investment Retirement Accounts

To Lock In More Security, Less Tax, and More Growth

Why It’s the Right Time to Secure Your Retirement.

Markets rise and fall, and no one knows when the next drop will come. For those nearing retirement, one bad year can erase years of progress.

A Secure Investment and Retirement Account (SIRA) protects your savings with a 0% floor, so your account value never declines during market downturns. It grows through indexing strategies tied to market performance, giving you potential gains without the risk of loss.

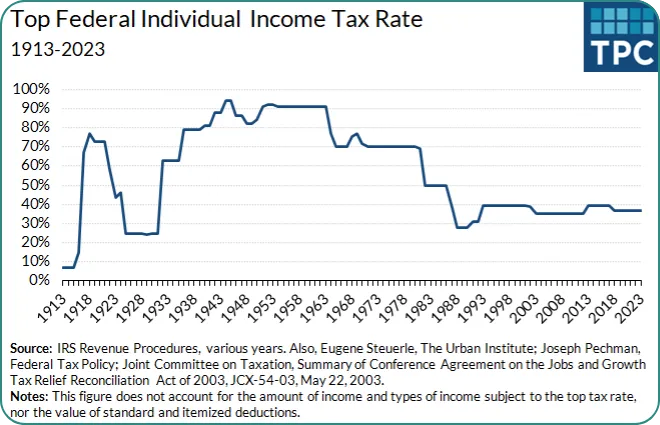

This chart compares a $100,000 contribution made in 2000 through the S&P 500 with a SIRA. While the S&P swung through ups and downs, the SIRA grew steadily and safely.

Most people never think about what happens if the market crashes after retirement. A SIRA keeps your money secure and your income dependable through every market condition.

A SIRA goes beyond protection. It helps your savings grow tax free for life.

Taxes are one of the biggest factors that can reduce your retirement income. You live on what remains after taxes, not before.

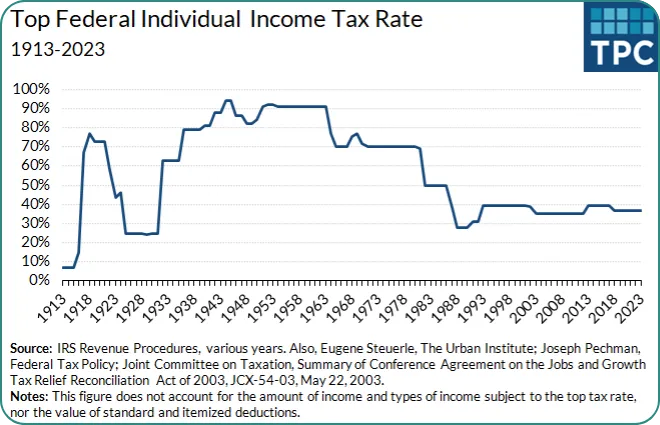

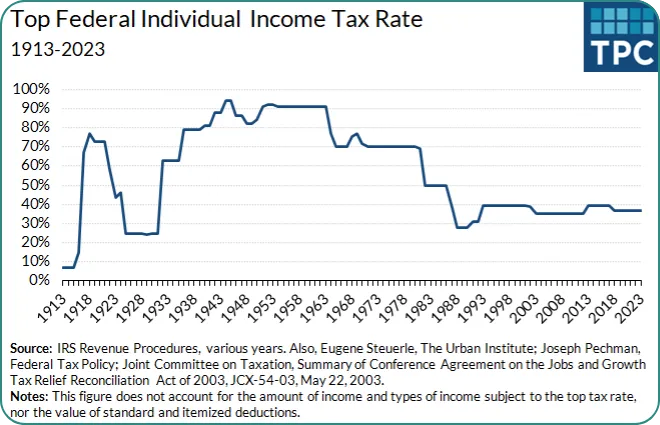

Today, we are in one of the lowest tax periods in history, but national debt continues to grow and future tax rates are likely to rise. Where do you think they will be in ten or twenty years? Probably higher than today.

A Secure Investment and Retirement Account (SIRA) helps you prepare by providing tax free growth, tax free access, and tax free legacy benefits. It allows your money to grow efficiently without being affected by future tax increases.

As shown in the chart beside this section, top federal income tax rates have changed dramatically over time. Planning ahead now can help you keep more of what you earn later.

A SIRA goes beyond protection. It helps your savings grow tax free for life.

Taxes are one of the biggest factors that can reduce your retirement income. You live on what remains after taxes, not before.

Today, we are in one of the lowest tax periods in history, but national debt continues to grow and future tax rates are likely to rise. Where do you think they will be in ten or twenty years? Probably higher than today.

A Secure Investment and Retirement Account (SIRA) helps you prepare by providing tax free growth, tax free access, and tax free legacy benefits. It allows your money to grow efficiently without being affected by future tax increases.

As shown in the chart beside this section, top federal income tax rates have changed dramatically over time. Planning ahead now can help you keep more of what you earn later.

Discover the Path to a Protected, Tax-Free Retirement During Your Complimentary SIRA Strategy Session

In just minutes, you will discover how to:

Protect Against Losses

Market ups and downs can erase years of savings, but a SIRA shields your money with a guaranteed 0% floor.

Grow Tax Free

Once your SIRA is set up, all growth and withdrawals can be completely tax free.

Access Your Money

Your funds stay liquid and available when you need them. No penalties, no restrictions.

Secure your retirement in 3 easy steps

Step 1

A SIRA Advisor will review your current retirement accounts and calculate exactly how much you are on track to earn from your investments including 401(k), IRA, TSP, and Social Security. This gives a clear picture of your current retirement outlook.

Step 2

Your SIRA Advisor will enter your information into our proprietary Secure Retirement Analyzer, which compares your current financial outlook with what you could achieve through a SIRA. The goal is to help you see clearly which option best supports your long-term retirement goals.

Step 3

After analyzing a wide range of retirement strategies available through SIRA, your SIRA Advisor will help you identify the best-performing account options designed to protect your money and maximize growth.

From there, we assist you in setting up your Secure Investment and Retirement Account and ensuring you are approved for this IRS-compliant strategy.

Customer Testimonials

I never even knew how much I’d have in retirement. Now I have a plan in place too. Thanks SIRA team!

John Doe

I never even knew how much I’d have in retirement. Now I have a plan in place too. Thanks SIRA team!

John Doe

I never even knew how much I’d have in retirement. Now I have a plan in place too. Thanks SIRA team!

John Doe

I never even knew how much I’d have in retirement. Now I have a plan in place too. Thanks SIRA team!

John Doe

Frequently Asked Questions

How Does a SIRA Compare to Traditional Options?

With a 401(k):

❌ Your savings are exposed to market losses.

❌ You carry the full risk of downturns.

❌ Access to personalized guidance is limited and often costly.

❌ There is no guaranteed lifetime income for you or your spouse.

With a Roth IRA:

✅ Your growth is tax free, but…

❌ You can only contribute a limited amount each year.

❌ Your account value still depends on market performance.

❌ Early withdrawals can lead to penalties and restrictions.

With a Secure Investment Retirement Account (SIRA):

✅ Your money is protected by a guaranteed floor of zero percent, so it never loses value when markets drop.

✅ All growth and withdrawals can be completely tax free when properly structured.

✅ You can contribute any amount without annual limits.

✅ You never need to report your SIRA growth as income to the IRS.

✅ Your funds remain accessible and liquid whenever you need them.

✅ Your account can provide dependable, long term income protection for you and your family.

Who Else Has Used This?

Walt Disney

He used a secure account like SIRA to help fund the creation of Disneyland.

Ray Kroc

The founder of McDonald’s relied on a similar structure to keep his business afloat in its early years.

J.C. Penney

He used his protected account to meet payroll and save his company during the Great Depression.

Jim Harbaugh

One of the most recognized coaches in college football is set to receive over $1 million a year in tax-free income through an account built like a SIRA.

And there are many more, from U.S. Presidents to major corporations, who have used strategies like SIRA to protect their wealth and grow it tax free.

If a SIRA is so powerful, why hasn’t my financial advisor told me about it?

Reason 1: Most financial advisors are not familiar with Secure Investment and Retirement Accounts or how to structure one to maintain full tax advantages for the account holder.

Reason 2: Many financial advisors only recommend the products their company allows them to sell, which limits what they can offer to their clients.

Who is a SIRA for?

Are you a high-income earner looking for smarter, more secure ways to build retirement savings beyond the traditional options?

Are you a business owner who wants to protect profits while planning for long-term financial security?

Are you looking for tax-advantaged growth with the ability to make tax-free withdrawals?

Do you have an old or underperforming 401(k), IRA, or TSP?

Do you want to participate in market growth without worrying about market losses?

Or maybe…

You keep running the numbers and find yourself pushing your retirement goals further and further away?

If you said yes, then a SIRA could be right for you.

To know for sure, click below and send us a quick message.

Do You Qualify For A Secure Investment Retirement Account?

By pre-qualifying, you are not making any commitment. This form simply helps our Secure Investment and Retirement Specialists understand your goals and evaluate the best way to protect your savings while maximizing growth and tax-free income.

For educational and informational purposes only. Secure Investment and Retirement Account (SIRA) does not provide tax, legal, accounting, investment, or financial advice.

Menu

Secure Investment and Retirement Account (SIRA) is a marketing initiative of Retire Wisely, LLC, designed to educate consumers about secure and tax-advantaged retirement strategies. It does not provide tax, legal, accounting, investment, or financial advice, and it does not make specific product recommendations.

Prospects who request additional information may be referred to a state-licensed insurance professional who has paid a fee to receive such referrals. These independent agents are not employees of Retire Wisely, LLC and may recommend products or carriers over which Retire Wisely has no control.

All examples, research, and illustrations on this website refer exclusively to insurance products offered by licensed agents. The information provided does not constitute an offer to buy, sell, or exchange securities and should not be the sole basis for financial decisions.

References to insurance-based strategies, including Indexed Universal Life (IUL) or Fixed Indexed Annuities, are for educational purposes only. Any guarantees mentioned are subject to the claims-paying ability of the issuing insurance company.

Discussions and materials presented are general in nature, based on certain assumptions, and do not guarantee future results. The appropriate product type and coverage amount depend on individual financial circumstances and goals.

This content is not a formal illustration of any specific insurance policy or annuity. Product terms and conditions are subject to change by the issuing insurer. Individuals should consult a qualified financial professional before making decisions about any referenced product or strategy.

For more details, please review the Terms of Use and Important Disclaimers available on this website.

© 2025 Secure Investment Retirement Account™. All Rights Reserved